Here's background info you should know, and key questions you need to ask your business tax expert.

Five years after Congress made the intermittently-funded Section 179 R&D tax credit permanent for manufacturers, it's still not being used by everyone who could be taking advantage of it. Recent tweaks to the federal Research and Development Tax Credit made by legislators have made this credit even more appealing and accessible.

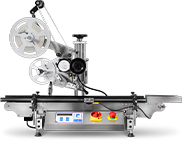

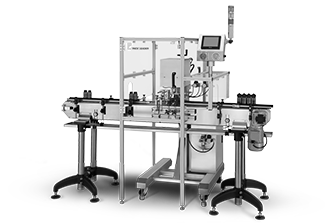

R&D isn’t reliant on patenting the next world-changing widget or manufacturing a new product. It can apply to qualified expenses such as wages, supplies used in R&D contract services, even new manufacturing equipment such as labeling, filling, and capping machines.

In addition to the tax benefits you could receive from the federal R&D credit, be sure to look into your state's tax laws for R&D credits. For example, Tax Point Advisors say R&D tax credits at the state level are available for the CBD industry.

You could be leaving money on the table at tax time, money that could be used for equipment upgrades, hiring staff, and other things vital to your business.

Of course, any tax advice that you act on should come from your accountant, not from an online article. With that disclaimer, our aim is to help you decide what questions you need to ask the tax expert of your choice.

A Brief History of the R&D Tax Credit

The Federal Research and Development Tax Credit was enacted in 1981 to allow a credit of up to 13% of eligible expenditures pertaining to new and improved products or processes. It was updated by Congress numerous times before being made permanent in 2015, and it has been tweaked since then to broaden its coverage.

What expenditures are eligible? The law provides a four-part test:

What expenditures are eligible? The law provides a four-part test:

- New or improved products, processes, or software - The purpose of the research should be the creation of a new or improved product or process.

- Technological in nature - Experimentation must rely on the hard sciences, such as engineering, physics, biology, chemistry, or computer science.

- Elimination of uncertainty - The experimentation must be aimed at reducing or eliminating technical uncertainty when producing the new product or process.

- Process of experimentation - By using modeling, simulation, systematic trial and error, or other means, a company must show that it has looked at various alternative methods for achieving the desired result.

The most significant change to the R&D tax credit came as part of the bipartisan Protecting Americans from Tax Hikes (PATH) Act of 2015, which permanently extended many business and individual incentives. As part of PATH, the R&D tax credit was made permanent rather than requiring periodic reauthorization by Congress.

Other improvements have been made since then to expand eligibility to more taxpayers and increase the size of the break. For example, as of this year, the basic credit is up to 20%, and there is a simplified alternative credit of 14%.

If things still seem fuzzy, you can understand why the whole subject is sometimes disregarded by owners of smaller manufacturing businesses. A few common misconceptions may be keeping you from getting to the point of asking your accountant about the R&D tax credit.

How to Know If Your Manufacturing Business Qualifies

Owners of small manufacturing businesses often miss the boat because either they don't know about the tax credit, or they believe they don't qualify for it. When you think of research and development, do you picture scientists in white lab coats using mass spectrometers and microscopes? The fact is you don't need degreed chemists or computer science majors to perform activities that qualify as legitimate research and development.

Here are some common areas of uncertainty:

- Which activities qualify as research

- What expenditures qualify for the credit

- What documentation sufficiently supports research

- How businesses use the credit

The law is actually pretty broad and does not require that you have an R&D lab staffed with scientists. You can perform R&D outdoors, in a test kitchen, on a production floor, or in your winery or distillery. You will, however, have to be scientifically rigorous, following proper research protocols and keep good records.

Your product, process, software, or technical innovation does not have to be new to your industry, merely to your company. What is necessary is that you show an increase in research and activities and expenditures, because the intent of the law is to reward increasing investment in pursuit of innovation.

Recent Fine-tuning May Improve the Deal

At the risk of repeating ourselves, we encourage you to talk to your accountant, who will be aware of the latest changes to the R&D tax credit. The good news is that it may apply to an expanded number of taxpayers due to legislation introduced in 2020 in response to the economic impact of the coronavirus shutdowns.

We hope this has inspired you to think creatively about how you might innovate while being rewarded for doing so by the IRS so that you can invest in the human assets and equipment you need to thrive and grow.

.webp?width=200&height=135&name=2x-Packleader-logo-large%20(1).webp)

.webp?width=360&name=2x-color-logo%20(1).webp)